Lennar Corporation

Name: Lennar Corporation

Symbol: LEN

Price: US $133.14

Release Date: Aug 2025

Forecast:

Theme: Value Investing, Warren Buffett

Website: https://www.lennar.com

Lennar Corporation, together with its subsidiaries, operates as a homebuilder primarily under the Lennar brand in the United States. It operates through Homebuilding East, Homebuilding Central, Homebuilding Texas, Homebuilding West, Financial Services, Multifamily, and Lennar Other segments.

Highlights

Rationale

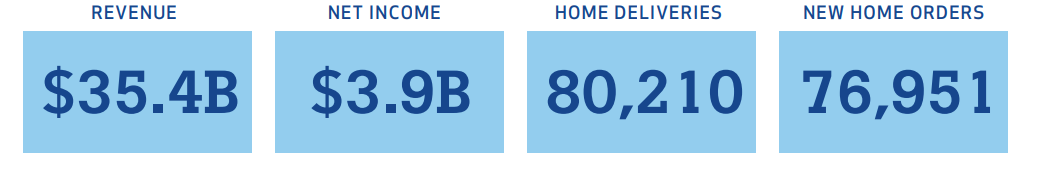

New home deliveries, including deliveries from unconsolidated entities, were 80,210 in fiscal 2024, compared to 73,087 in fiscal 2023 and 66,399 in fiscal 2022.

For the last several years, Company have been reducing our reliance on land own and increasing access to land through options and joint ventures, most significantly through use of land banks which is a critical part of operating strategy. At November 30, 2024, 82% of total homesites were controlled through options with land banks, land sellers and joint ventures compared to 76% at November 30, 2023.

New home deliveries, including deliveries from unconsolidated entities, were 80,210 in fiscal 2024, compared to 73,087 in fiscal 2023 and 66,399 in fiscal 2022. We primarily sell homes in communities targeted to first-time, move-up, active adult, and luxury homebuyers.

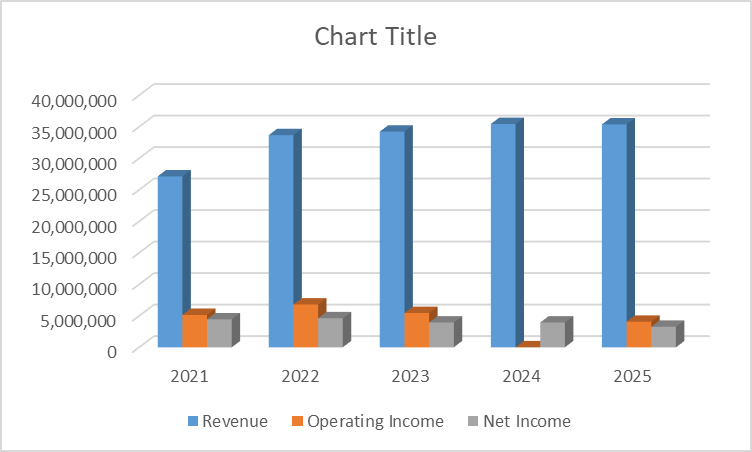

Income Statement

Threats & Risks

- Demand for homes built may be adversely affected by a variety of macroeconomic factors beyond our control.

- Negative publicity could hurt reputation, which could cause revenues or results of operations to decline

- Business strategies for homebuilding and mortgage finance businesses may not increase value.

- The market for new homes is cyclical, and a continuing downturn in the homebuilding market could adversely affect operations.

- Inflation could adversely affect profitability Further increases in mortgage interest rates could reduce potential buyers’ ability or desire to obtain financing with which to buy homes.

- A decline in prices of new homes could require us to write down the carrying value of land we own and to write off option costs.

- Current and threatened international conflicts could affect demand for the homes built

- Results of operations and financial condition may be adversely affected by public health issues and resulting governmental actions.

- Homebuilding, mortgage lending, and home rentals are very competitive industries, and competitive conditions could adversely affect business or financial results.

- The company may be subject to costs of warranty and liability claims in excess of the insurance coverage we can purchase.

- Excessive health and safety incidents relating to our operations could be costly to the company.

Summary

Based on the factors above company is having Multibagger properties. Investor can expect 10-20X returns in a 5-10 year holding period.