Multibagger#11 NVIDIA Corporation (NVDA)

Name : NVIDIA Corporation

Symbol: NVDA

Price: $106.00

Release Date: April 2025

Forecast:

Theme: Value Investing, Warren Buffett

Story: NVIDIA Corporation, a computing infrastructure company, provides graphics computing, and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Website: https://www.nvidia.com

Highlights

Rationale

NVIDIA’s accelerated computing ecosystem is bringing AI to every enterprise. The NVIDIA ecosystem spans nearly 5 million developers and 40,000 companies. More than 1,600 generative AI companies are building on NVIDIA. CUDA, a parallel computing model launched in 2006, offers developers more than 300 libraries, 600 AI models, numerous SDKs, and 3,500 GPU-accelerated applications. CUDA has more than 48 million downloads.

this year, every next-generation Mercedes-Benz vehicle will include an NVIDIA software-defined computing architecture that includes the most powerful computer, system software, and applications for consumers.

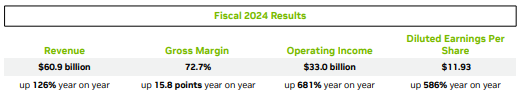

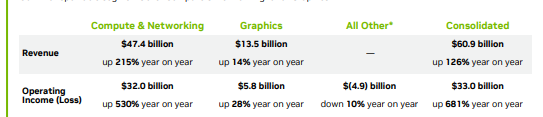

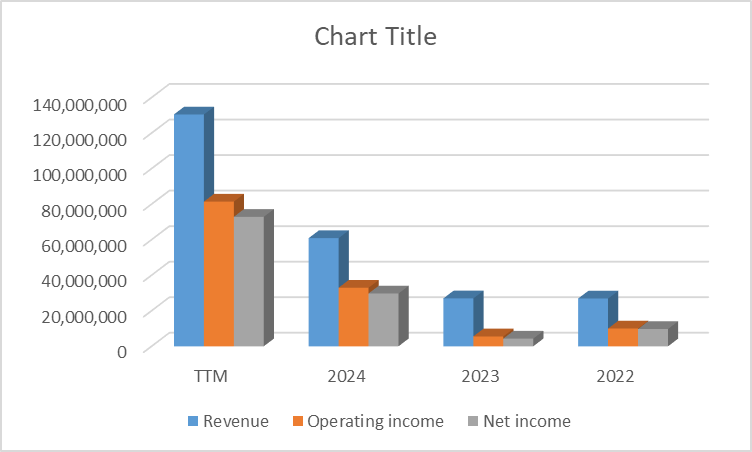

For fiscal 2024, revenue was up 126% to a record $60.9 billion. GAAP earnings per diluted share was $11.93, up 586% from a year ago. Non-GAAP earnings per diluted share were $12.96, up 288% from a year ago. Non-GAAP gross margin was 73.8%.

Income Statement

Threats & Risks

-

Failure to meet the evolving needs of industry may adversely impact financial results.

-

Competition could adversely impact market share and financial results.

-

Failure to estimate customer demand accurately has led and could lead to mismatches between supply and demand.

-

Dependency on third-party suppliers and their technology to manufacture, assemble, test, or package products reduces our control over product quantity and quality, manufacturing yields, and product delivery schedules and could harm business.

-

Defects in products have caused and could cause us to incur significant expenses to remediate and could damage business.

-

Adverse economic conditions may harm our business.

-

International sales and operations are a significant part of business, which exposes us to risks that could harm business.

-

product, system security and data breaches and cyber-attacks could disrupt operations and adversely affect financial condition, stock price and reputation.

-

Business disruptions could harm operations and financial results.

-

Climate change may have a long-term impact on business.

-

We may not be able to realize the potential benefits of business investments or acquisitions, nor successfully integrate acquisition targets.

-

A significant amount of revenue stems from a limited number of partners and distributors and we have a concentration of sales to end customers, and revenue could be adversely affected if we lose or are prevented from selling to any of these end customers.

-

We may be unable to attract, retain and motivate executives and key employees.

-

Modification or interruption of business processes and information systems may disrupt business, and internal controls.

-

operating results have in the past fluctuated and may in the future fluctuate, and if operating results are below the expectations of securities analysts or investors, stock price could decline.

Summary

Based on the factors above company is having Multibagger properties. Investor can expect 10-20X returns in a 5-10 year holding period.