Multibagger#12 Instacart (CART)

Name: Instacart aka Maplebear Inc

Symbol: CART

Price: $ 45.06

Release Date: May 2025

Forecast: 10X Returns 5 Years

Theme: Value Investing, Warren Buffett

Story: Maplebear Inc., doing business as Instacart, engages in the provision of online grocery shopping services to households in North America. Its service can be provided through company's mobile application or website. The company also provides advertising services; and software-as-a-service solutions. Maplebear Inc

Website: https://www.instacart.com

Highlights

Rationale

Launched Smart Shop, a new technology that makes it easier for customers to discover new options or buy their favorites. The technology provides recommendations by leveraging our unique data and unparalleled understanding of customer preferences, such as shopping habits from previous purchases and searches.

Introduced Store View, a new inventory intelligence technology designed to improve overall order quality by using AI to analyze video footage and enhance our real-time understanding of what’s on store shelves.

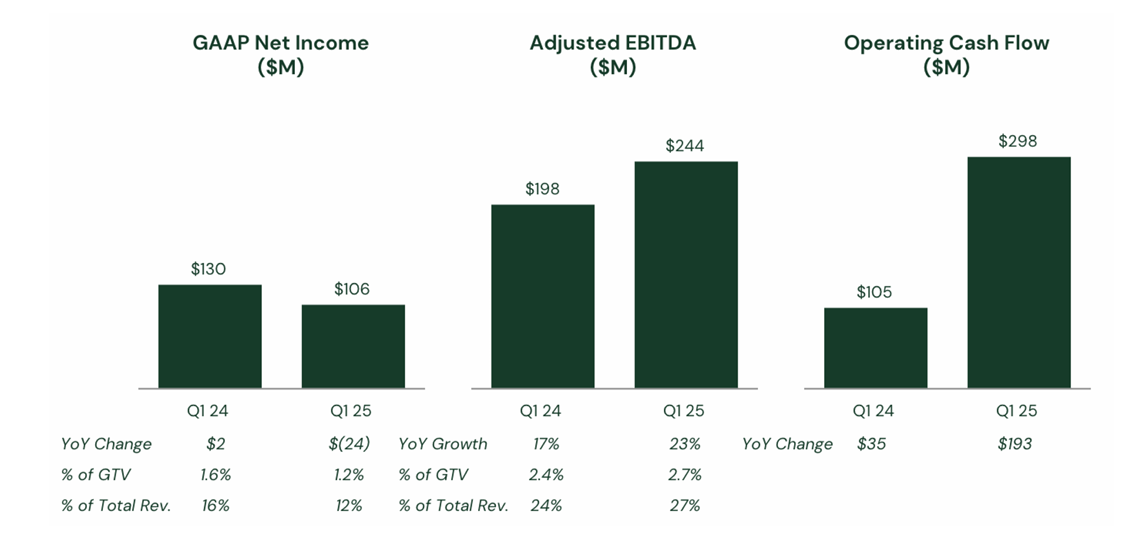

Orders were 83.2 million, up 14% year-over-year – the fastest growth in 10 quarters. This drove GTV to $9,122 million, up 10% year-over-year. Total revenue was $897 million, up 9% year-over-year, primarily driven by GTV growth.

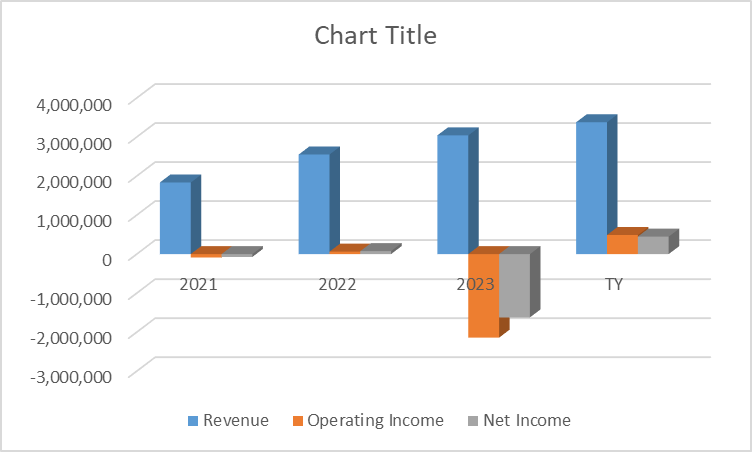

Income Statement

Threats & Risks

-

If company fail to cost-effectively acquire new customers or increase the engagement of existing customers, including through effective marketing strategies, business would be harmed.

-

Company have a limited history operating business at its current scale, scope, and complexity in an evolving market and economic environment, which makes it difficult to plan for future operations and strategic initiatives, predict future results, and evaluate future prospects and the risks and challenges may encounter.

-

Company have a history of losses, and we may be unable to sustain or increase profitability or generate profitable growth in the future.

-

The success of business is dependent on relationships with retailers. The loss of one or more of retail partners or reduction in their engagement with Instacart could harm business.

-

Company are continuing to build Instacart Ads offerings. If Company fail to grow advertising revenue, business, financial condition, and results of operations would be negatively impacted.

-

The markets in which company participate are highly and increasingly competitive, with well-capitalized and better-known competitors, some of which are also partners. If company are unable to compete effectively, business and financial prospects would be adversely impacted.

-

If company fail to cost-effectively engage shoppers on Instacart, or attract and retain shoppers, our business could be harmed.

-

The failure to achieve increased market acceptance of online grocery shopping and offerings could seriously harm business.

-

Mergers or other strategic transactions by competitors or retailers could weaken competitive position and adversely affect business.

-

Company expect a number of factors to cause results of operations and operating cash flows to fluctuate on a quarterly and annual basis, which may make it difficult to predict future performance.

-

If the contractor status of shoppers who use Instacart is successfully challenged, or if additional requirements are placed on engagement of independent contractors, we may face adverse business, financial, tax, legal, and other consequences.

-

The trading price of common stock may be volatile and could decline significantly and rapidly. You may be unable to sell your shares of common stock at or above the price at which you purchased them.

Summary

Based on the factors above company is having Multibagger properties. Investor can expect 10-20X returns in a 5-10 year holding period.