Multibagger #15 IREN Limited

Name: Iren Limited

Symbol: IREN

Price: $46.50

Release Date: Nov 15, 2025

Forecast:

Theme: Value Investing, Warren Buffett

Story: IREN Limited operates in the vertically integrated data center business in Australia and Canada. The company owns and operates computing hardware, as well as electrical infrastructure and data centers. It also mines Bitcoin, a scarce digital asset that is created and transmitted through the operation of a peer-to-peer network of computers running the Bitcoin software.

Website:https://iren.com

Stock chart

Rationale

On 19 August 2024, the Group entered into a new firm purchase agreement with Bitmain Technologies Delaware Limited to purchase approximately 39,000 Bitmain S21 XP miners (approximately 10.5 EH/s) at a price of $21.5/TH.

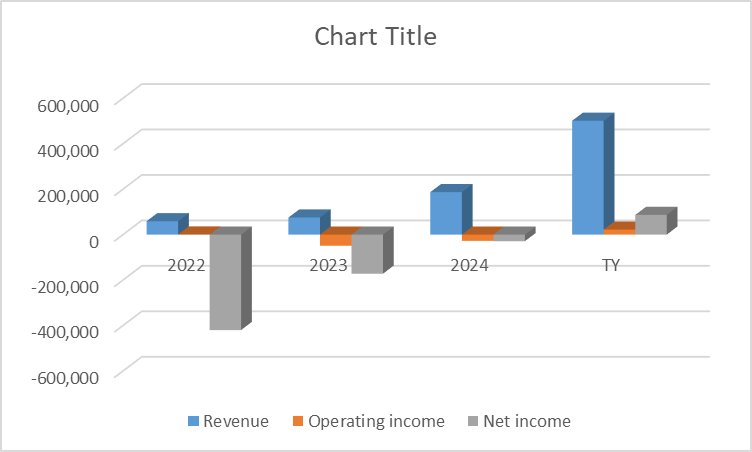

Total revenue increased to record $240.3m (+355% vs. Q1 FY25 $52.8m) ,Net income increased to record $384.6m (vs. Q1 FY25 net loss $(51.7)m) Adj, EBITDA increased to $91.7m (+3,568% vs. Q1 FY25 $2.5m) 4 ,EBITDA increased to record $662.7m.

Accelerating construction of Horizon 1-4 (200MW critical IT load) liquid-cooled data centers for Microsoft.

Significant enhancements to original Horizon design, including Tier 3-equivalent concurrent maintainability, 100MW superclusters for high-performance training, and flexible rack densities (130-200kW)

Income statement

Fundamentals, Valuations, Growth

Threats & Risks

- The Group undertakes certain transactions denominated in foreign currency and is exposed to foreign currency risk through

foreign exchange rate fluctuations. - The Group has limited exposure to interest rate risk, which is the risk that a financial instrument's value will fluctuate as a result of changes in the market interest rates on variable interest-bearing financial instruments. The Group does not, at this time, use derivatives to mitigate these exposures. The Group's cash and cash equivalents consist of balances available on

demand and term deposits. - he Group is exposed to daily price risk on Bitcoin rewards it generates through contributing computing power to mining pools. Bitcoin rewards are typically liquidated on a daily basis and no Bitcoin is held as at the reporting period.

- The Group's exposure to credit risk is primarily related to its potential counterparty credit risk with exchanges, mining pools and regulated financial institutions. It mitigates credit risk associated with mining pools and exchanges by maintaining relationships with various alternative mining pools and transferring fiat currency to its Australian bank account on a regular

basis. - The Group is exposed to liquidity risk and is required to maintain sufficient liquid assets (mainly cash and cash equivalents) and available borrowing facilities to be able to pay contractual obligations as and when they become due and payable. The Group manages liquidity risk by continuously monitoring forecast and actual cash flows and matching the maturity profiles

of financial assets and liabilities.

Summary

Based on the factors above company is having Multibagger properties. Investor can expect 10-20X returns in a 5-10 year holding period.