Multibagger#7 CarMax

Name: CarMax, Inc.

Symbol: KMX

Price: $ 11.419B

Release Date: OCT 2024

Forecast:

Theme: Value Investing, Warren Buffett

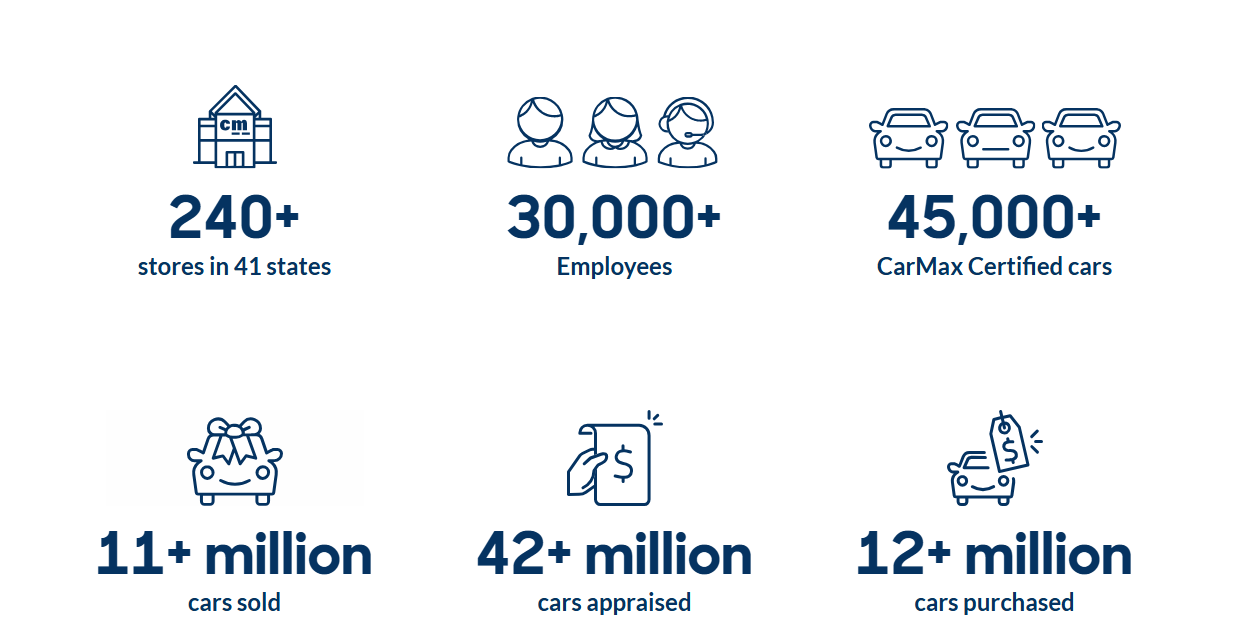

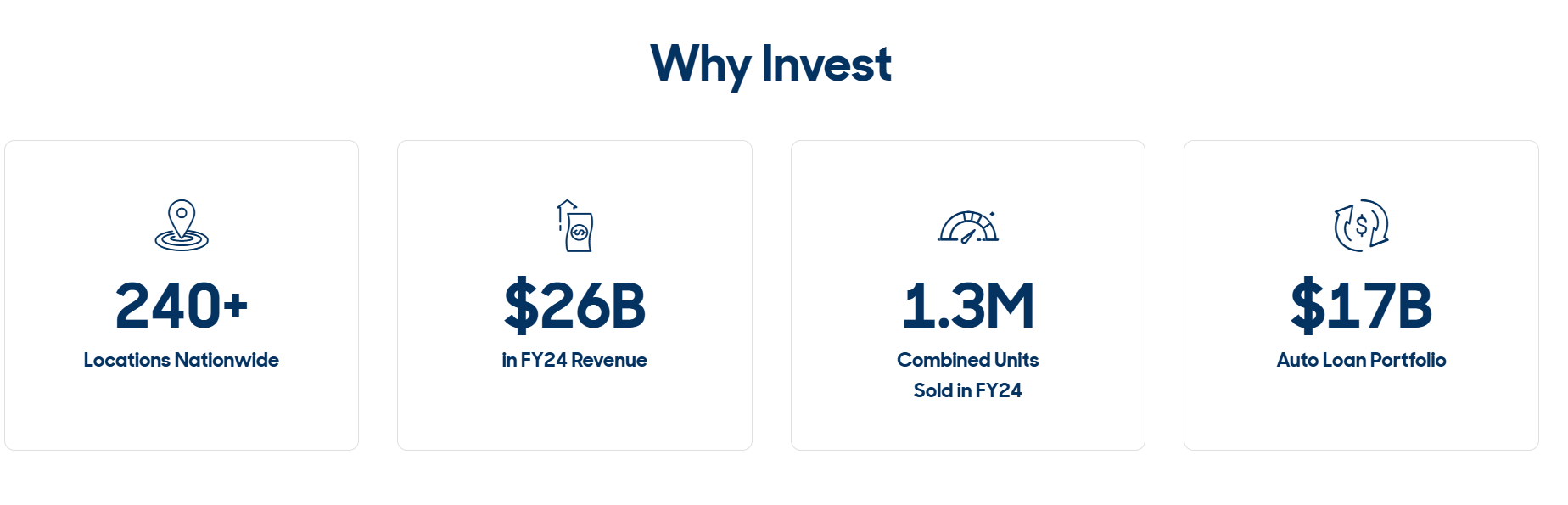

Story: CarMax, Inc. is a used vehicle retailer based in the United States. It operates two business segments: CarMax Sales Operations and CarMax Auto Finance. The company began as a side business of Circuit City, opening its first location in Richmond, Virginia. CarMax operates 238 locations.

Website: https://www.carmax

Highlights

Rationale

The company anticipates opening a total of seven locations in fiscal 2025, including five stores, one stand-alone reconditioning center, and one stand-alone auction facility. currently estimated capital expenditures will total between $500 million and $550 million in fiscal 2025. Capital expenditures were $465.3 million in fiscal 2024.

omni-channel experience provides a common platform across all of CarMax that leverages the company's scale, nationwide footprint, and infrastructure and empowers customers to buy a vehicle on their terms, whether online, in-store, or through an integrated combination of online and in-store experiences. The company expects online and omni sales to grow over time.

CarMax is forecast to grow earnings and revenue by 19.4% and 2.3% per annum respectively. EPS is expected to grow by 20.7% per annum. Return on equity is forecast to be 13.3% in 3 years.

The company's forecast earnings growth (19.4% per year) is above the savings rate (2.5%).

Income Statement

Threats & Risks

- operate in a highly competitive industry. Failure to develop and execute strategies to remain the nation’s preferred retailer of used vehicles and to adapt to the increasing use of digital and online tools to market, buy, sell, and finance used vehicles could adversely affect business, sales, and results of operations.

- Company collect sensitive confidential information from customers. A breach of this confidentiality, whether due to cybersecurity or other incident could result in harm to our customers and damage to our brand.

- Company operate in a highly regulated industry and are subject to a wide range of federal, state and local laws and regulations. Changes in these laws and regulations, or failure to comply, could have a material adverse effect on business, sales, results of operations, and financial condition for the risks associated with failure to comply with these laws and regulations.

- Company rely on sophisticated information systems to run business. The failure of these systems or the inability to enhance capabilities could have a material adverse effect on business, sales, and results of operations.

- Company subject to evolving regulations, disclosure requirements, and expectations relating to environmental, social and governance matters. Failure to satisfy these regulations, requirements, and expectations could adversely affect business, sales, results of operations and financial condition.

- The market price of common stock may be volatile and could expose to securities class action litigation.

- Company subject to various legal proceedings. If the outcomes of these proceedings are adverse to CarMax, it could have a material adverse

effect on business, results of operations and financial condition.

Summary

Based on the factors above company is having Multibagger properties. Investor can expect 10-20X returns in a 5-10 year holding period.