Multibagger#8 (Paid)

Name: Super Micro Computer

Symbol: SMCI

Price: $19.436B

Release Date: NOV 2024

Forecast:

Theme: Value Investing, Warren Buffett

Story: American information technology. company based in San Jose, California. The company is one of the largest producers of high-performance and high-efficiency servers, while also providing server management software, and storage systems for various markets, including enterprise data centers, cloud computing, artificial intelligence,5G, and edge computing.

Website:https://www.supermicro.com

Highlights

Rationale

In fiscal year 2023, Company announced more than 50 products supporting Intel’s new Sapphire Rapids data center CPU. During the second half of fiscal year 2023, our product portfolio was enhanced to support AMD’s Genoa data center CPU. In March 2023, the Company released a high-density petascale class all-flash NVMe server family supporting next-generation EDSFF form factor, including the E3.S and E1.S devices. Also in March 2023, Company unveiled a comprehensive portfolio of GPU systems including servers in 8U, 6U, 5U, 4U, 2U, and 1U form factors, as well as workstations that support the full range of new NVIDIA H100 GPUs.

The company plan to continue to increase our worldwide manufacturing capacity and logistics abilities in the United States, Taiwan and the Netherlands to more efficiently serve our customers and lower our overall manufacturing costs.

The company offers a broad range of accelerated compute platforms that are application-optimized server solutions, rackmount and blade servers, storage, and subsystems and accessories, which can be used to build complete server and storage systems. These Total IT Solutions and products are designed to serve a variety of markets, such as enterprise data centers, cloud computing, AI and 5G/edge computing.

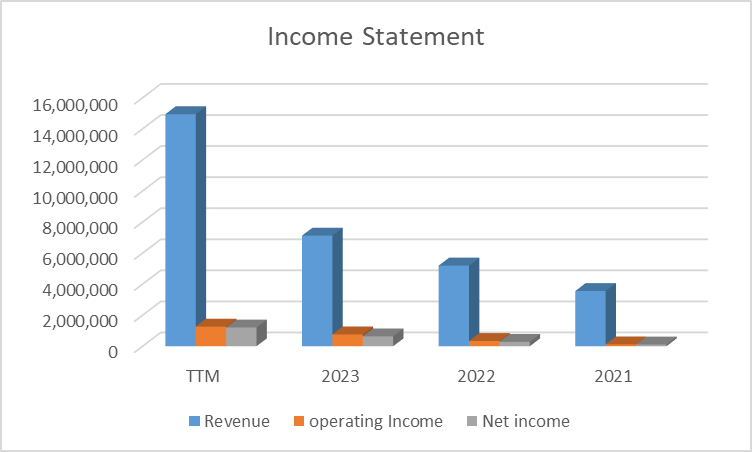

Income Statement

Threats & Risks

- Adverse economic conditions may harm business.

- Recent events in eastern Europe and the Taiwan Strait present challenges and risks to company, and no assurances can be given that current future developments would not have a material adverse effect on business, results of

operations and financial condition. - Quarterly operating results have fluctuated and will likely fluctuate in the future.

- Revenue and margins for a particular period are difficult to predict, and a shortfall in revenue or decline in margins may harm our operating results.

- As increasingly target larger customers and larger sales opportunities, customer base may become more concentrated, companies cost of sales may increase, margins may be lower, borrowings may be higher with effects on

cash flow, company are exposed to inventory risks, and sales may be less predictable. - If company fail to meet any publicly announced financial guidance or other expectations about business, it could cause stock to decline in value.

- Company may be unable to secure additional financing on favorable terms, or at all, which in turn could impair the rate of growth.

- Increases in average selling prices for Total IT Solutions have historically significantly contributed to increases in net sales in some of the periods covered. Such prices are subject to decline if customers do not continue to purchase latest generation products or additional components, which could harm results of operations.

Summary

Based on the factors above company is having Multibagger properties. Investor can expect 10-20X returns in a 5-10 year holding period.