Multibagger#9 Pool Corporation

Name: Pool Corporation

Symbol: POOL

Price: 13.382B

Release Date: Jan 2025

Forecast:

Theme: Value Investing, Warren Buffett

Story: Pool Corporation, doing business as POOLCORP, is the largest distributor of supplies, equipment, and machinery for swimming pools worldwide. The company is organized in Delaware and headquartered in Covington, Louisiana. It serves approximately 125,000 customers and operates 439 sales centers in North America, Europe and Australia.

Website: https://www.poolcorp.com/

Highlights

Rationale

Company recently launched Pool360 WaterTest and are in the process of rolling out Pool360 Pool Service under Pool360 platform of technologies. Pool360 Water Test is a professional water testing software available to retail customers that works with our complete line of proprietary brand pool and hot tub chemicals. Pool360 PoolService app is a mobile tool that allows pool professionals to better manage their service business and improve their customers’ experience.

Company grown distribution networks through new sales center openings, acquisitions and the expansion of existing sales centers depending on market presence and capacity.

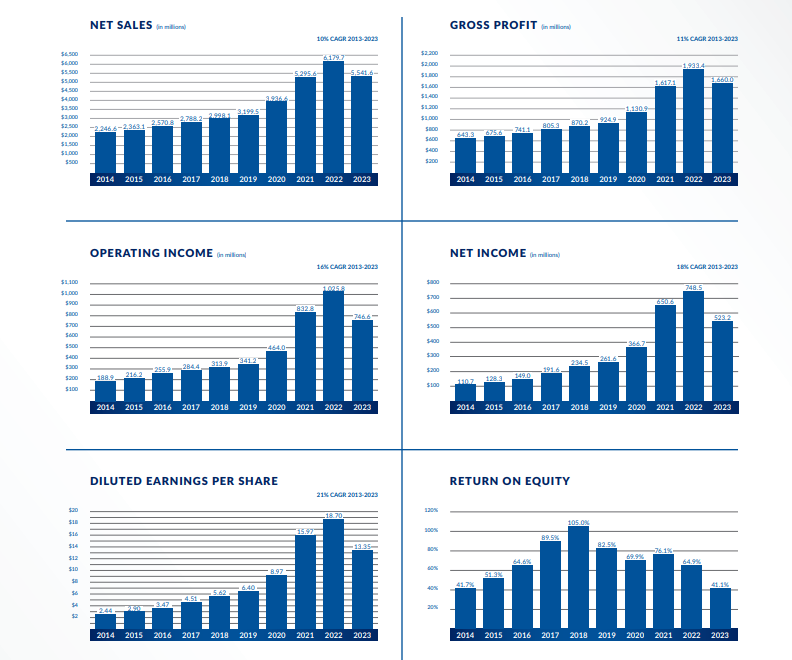

Operating income was up 119% over 2019, a 22% CAGR over the four-year period, contributing to a stepped-up operating margin, demonstrating the benefits of scale, capacity creation efforts and customer-focused operations. Diluted earnings per share of $13.35 reset the bar from last years ,record of $18.70 but has grown at a CAGR of 20% since 2019.

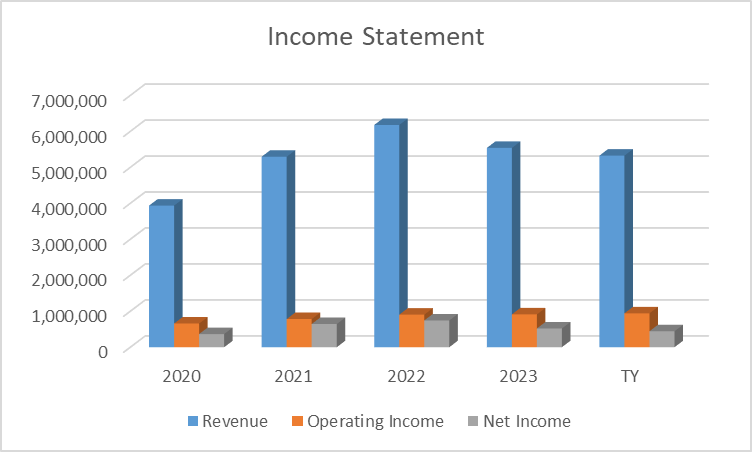

Income Statement

Threats & Risks

- The demand for products may be adversely affected by unfavorable economic conditions and changes in consumer discretionary spending.

- An outbreak of disease or similar public health threat, such as the recent COVID-19 pandemic, could adversely impact business and results of operations.

- Other catastrophic events or societal unrest could adversely impact our operations.

- Weather conditions, which could intensify as a result of climate change.

- distribution business is highly dependent on our ability to maintain favorable and stable relationships with supplier

- Failure to achieve and maintain a high level of product and service quality and safety could damage reputation, expose company to litigation and negatively impact financial performance.

- Company faces intense competition both from within our industry and from other leisure product alternatives.

- More aggressive competition by store- and internet-based mass merchants and large pool or irrigation supply retailers could adversely affect sales.

- Company depend on companys ability to attract, develop and retain highly qualified personnel

- Past growth may not be indicative of future growth.

- Company subject to inventory management risks. Insufficient inventory may result in lost sales opportunities or delayed revenue, while excess inventory may negatively impact gross margin.

Summary

Based on the factors above company is having Multibagger properties. Investor can expect 10-20X returns in a 5-10 year holding period.